Transcribed Image Text from this Question

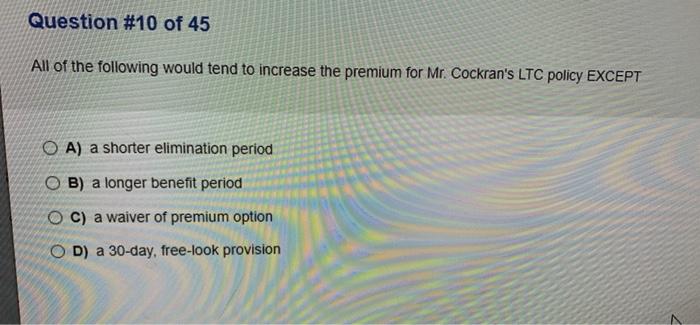

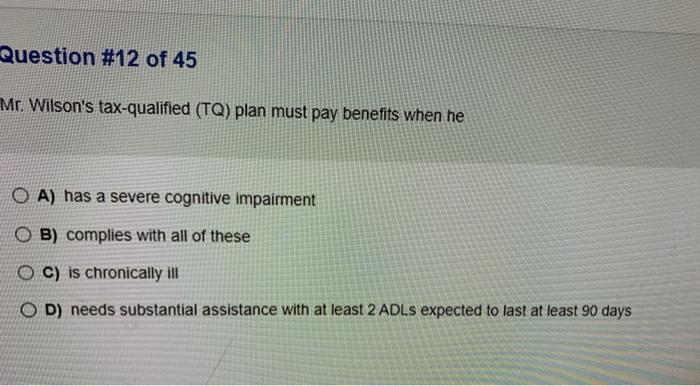

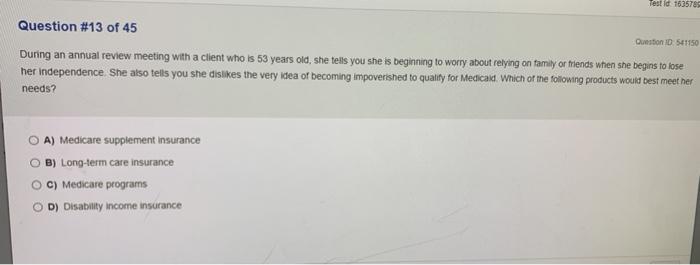

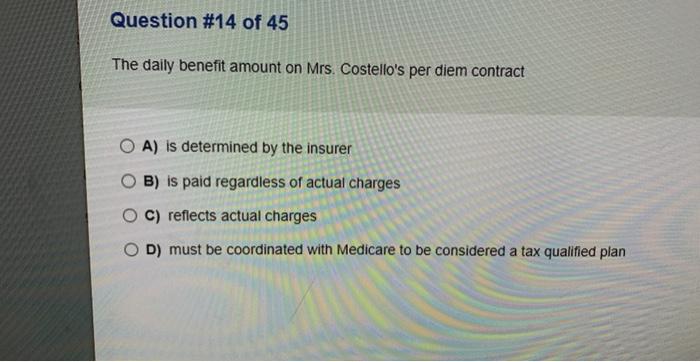

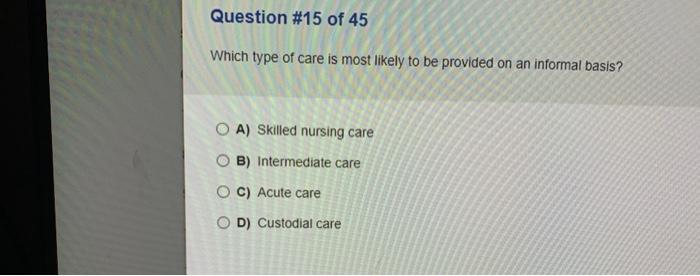

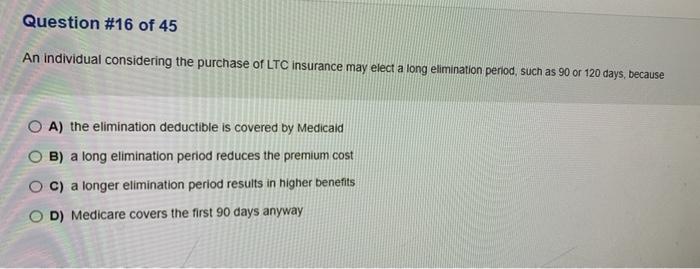

Question #10 of 45 All of the following would tend to increase the premium for Mr. Cockran’s LTC policy EXCEPT O A) a shorter elimination period B) a longer benefit period O C) a waiver of premium option OD) a 30-day, free-look provision Question #12 of 45 Mr. Wilson’s tax-qualified (TQ) plan must pay benefits when he O A) has a severe cognitive impairment B) complies with all of these C) is chronically ill OD) needs substantial assistance with at least 2 ADLs expected to last at least 90 days Testid 163578 Question #13 of 45 Question 10 541150 During an annual review meeting with a client who is 53 years old, she tells you she is beginning to worry about relying on family or friends when she begins to lose her Independence. She also tells you she dislikes the very idea of becoming impoverished to quality for Medicaid. Which of the following products would best meet her needs? A) Medicare supplement Insurance OB) Long-term care insurance c) Medicare programs OD) Disability income insurance Question #14 of 45 The daily benefit amount on Mrs. Costello’s per diem contract OA) is determined by the insurer OB) is paid regardless of actual charges C) reflects actual charges OD) must be coordinated with Medicare to be considered a tax qualified plan Question #15 of 45 Which type of care is most likely to be provided on an informal basis? O A) Skilled nursing care OB) Intermediate care O c) Acute care OD) Custodial care Question #16 of 45 An individual considering the purchase of LTC insurance may elect a long elimination period, such as 90 or 120 days, because O A) the elimination deductible is covered by Medicaid B) a long elimination period reduces the premium cost O c) a longer elimination period results in higher benefits D) Medicare covers the first 90 days anyway

(Visited 9 times, 1 visits today)