Transcribed Image Text from this Question

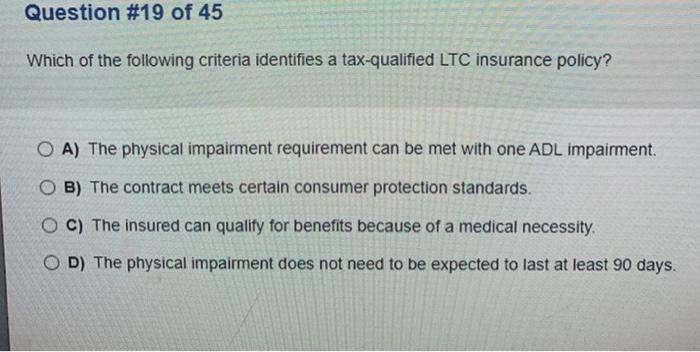

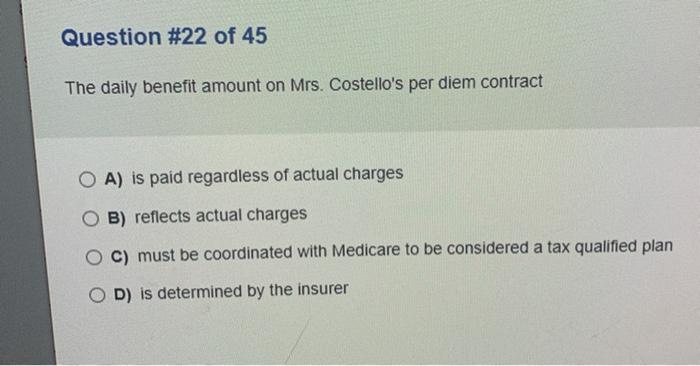

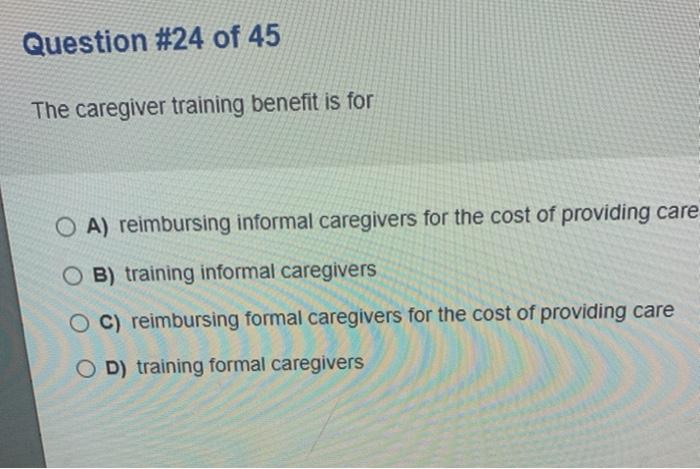

Question #19 of 45 Which of the following criteria identifies a tax-qualified LTC insurance policy? O A) The physical impairment requirement can be met with one ADL impairment. O B) The contract meets certain consumer protection standards. O C) The insured can qualify for benefits because of a medical necessity. OD) The physical impairment does not need to be expected to last at least 90 days. Question #22 of 45 The daily benefit amount on Mrs. Costello’s per diem contract O A) is paid regardless of actual charges O B) reflects actual charges C) must be coordinated with Medicare to be considered a tax qualified plan OD) is determined by the insurer Question #24 of 45 The caregiver training benefit is for O A) reimbursing informal caregivers for the cost of providing care OB) training informal caregivers O C) reimbursing formal caregivers for the cost of providing care OD) training formal caregivers

(Visited 5 times, 1 visits today)