Transcribed Image Text from this Question

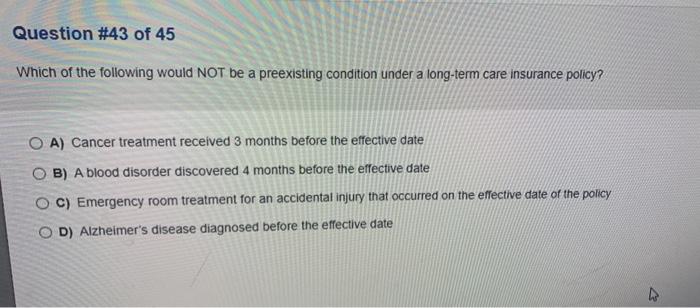

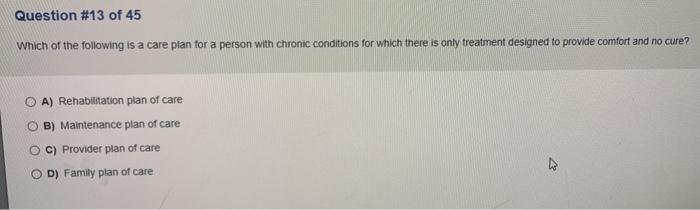

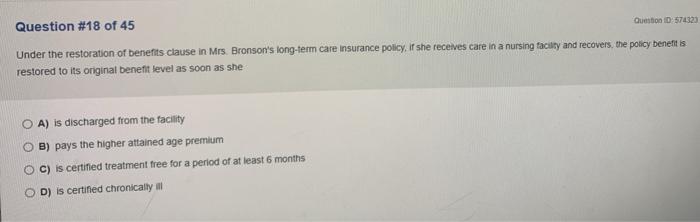

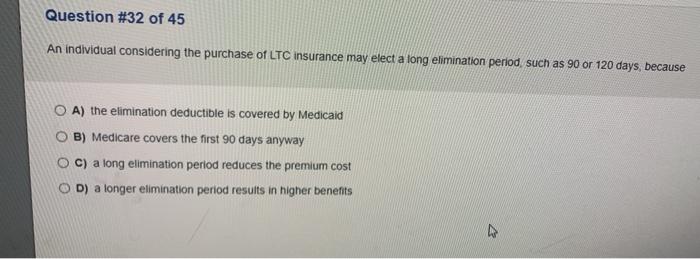

Question #43 of 45 Which of the following would NOT be a preexisting condition under a long-term care insurance policy? O A) Cancer treatment received 3 months before the effective date OB) A blood disorder discovered 4 months before the effective date O C) Emergency room treatment for an accidental injury that occurred on the effective date of the policy D) Alzheimer’s disease diagnosed before the effective date Question #13 of 45 Which of the following is a care plan for a person with chronic conditions for which there is only treatment designed to provide comfort and no cure? OA) Rehabilitation plan of care OB) Maintenance plan of care OC) Provider plan of care . OD) Family plan of care Question ID: 574323 Question #18 of 45 Under the restoration of benefits clause in Mrs. Bronson’s long-term care insurance policy. If she receives care in a nursing facility and recovers, the policy benefits restored to its original benefit level as soon as she A) is discharged from the facility OB) pays the higher attained age premium OC) is certified treatment free for a period of at least 6 months OD) is certified chronically all Question #32 of 45 An individual considering the purchase of LTC insurance may elect a long elimination period, such as 90 or 120 days, because OA) the elimination deductible is covered by Medicaid B) Medicare covers the first 90 days anyway OC) a long elimination period reduces the premium cost D) a longer elimination period results in higher benefits

(Visited 5 times, 1 visits today)