Transcribed Image Text from this Question

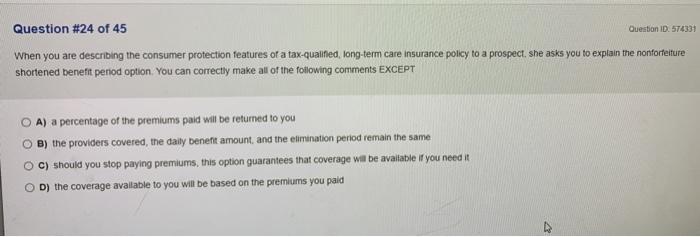

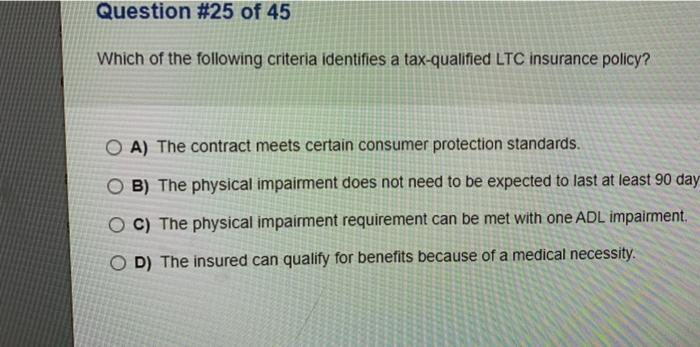

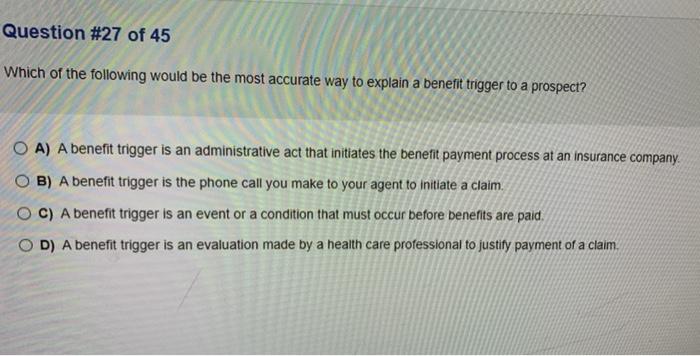

Question ID: 574331 Question #24 of 45 When you are describing the consumer protection features of a tax-qualined, long-term care insurance policy to a prospect, she asks you to explain the nonforte ture shortened benefit period option. You can correctly make all of the following comments EXCEPT A) a percentage of the premiums paid will be returned to you B) the providers covered the daily benefit amount, and the elimination period remain the same OC) should you stop paying premiums, this option guarantees that coverage will be available if you need it OD) the coverage available to you will be based on the premiums you paid Question #25 of 45 Which of the following criteria identifies a tax-qualified LTC insurance policy? O A) The contract meets certain consumer protection standards. O B) The physical impairment does not need to be expected to last at least 90 day O C) The physical impairment requirement can be met with one ADL impairment. OD) The insured can qualify for benefits because of a medical necessity. Question #27 of 45 Which of the following would be the most accurate way to explain a benefit trigger to a prospect? A) A benefit trigger is an administrative act that initiates the benefit payment process at an insurance company. OB) A benefit trigger is the phone call you make to your agent to initiate a claim. OC) A benefit trigger is an event or a condition that must occur before benefits are paid D) A benefit trigger is an evaluation made by a health care professional to justify payment of a claim

(Visited 5 times, 1 visits today)